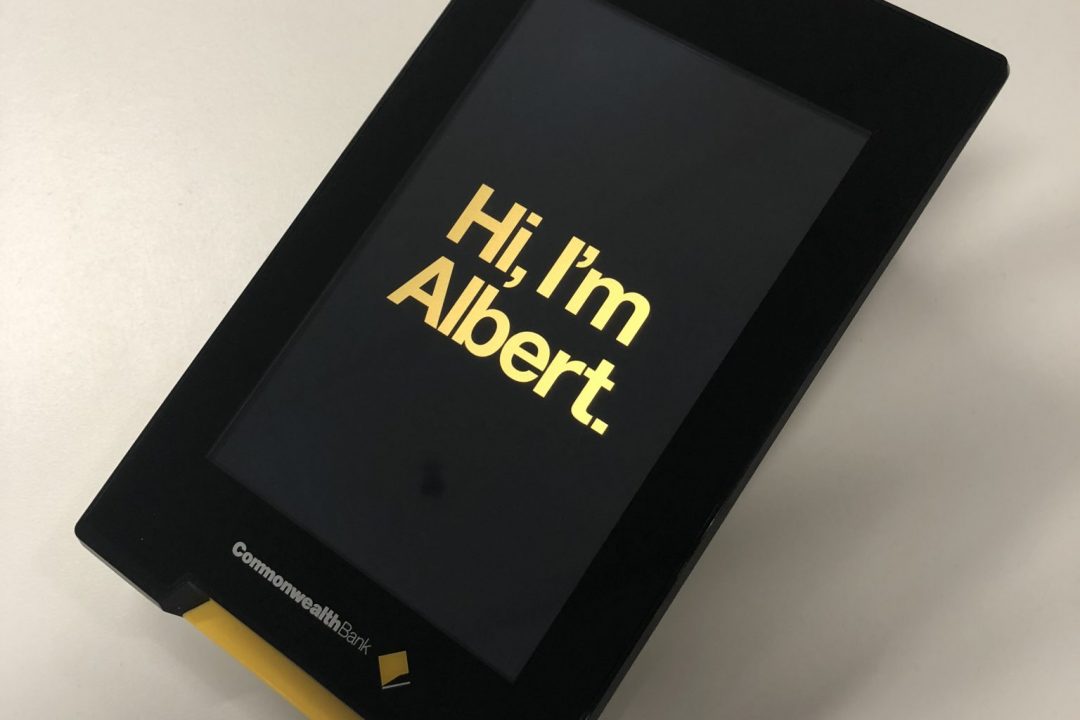

Legal action challenging the accessibility of the Commonwealth Bank of Australia’s touch-screen ‘Albert’ EFTPOS machines for people who are blind or vision impaired has settled, with the CBA agreeing to introduce a range of changes to ensure better accessibility of the Albert machines and committing to accessibility in future product development.

In settling the claim brought by Graeme Innes and Nadia Mattiazzo, the CBA has acknowledged the difficulty Mr Innes, Ms Mattiazzo and other Australians who are blind or vision impaired have experienced using Albert’s touchscreen technology to enter their PINs.

The CBA will soon release an upgrade to the Albert’s software which includes accessibility enhancements, following the feedback provided by Mr Innes and Ms Mattiazzo and members of Blind Citizens Australia.

The CBA has also endorsed the Australian Banking Association Accessibility Principles for Banking Services and agreed to roll out additional training for merchants to increase awareness of the Albert machine’s enhanced accessibility feature. This will include training sessions in capital cities throughout Australia, the publication of an instructive video for merchants, and reminders on the CBA’s invoices to merchants about how to use the accessibility feature.

PIAC represented Mr Innes and Ms Mattiazzo in their case against the bank, which was backed by Grata Fund, and settled on 18 December.

‘We have been raising these issues since 2016 and we appreciate that the bank has listened to our feedback and is taking steps to improve the accessibility of the Albert. It is so important that technology like this allows people with disability to fully participate in public life,’ said Nadia Mattiazzo.

‘I commend the bank for listening to our feedback and making these improvements. Most importantly, the bank has committed to ensuring accessibility will be a key requirement of product development in future. I look forward working together with CBA and the banking industry to identify accessibility solutions, including to explore emerging technologies such as tactile overlays, which may offer a simple and practical answer to this issue’ said Graeme Innes.

PIAC Senior Solicitor Michelle Cohen said: ‘New technology promises great benefits to consumers, but it has to be inclusive and accessible. This must be part of the design process from the beginning. We hope this case and the CBA’s commitment to accessibility in future product development sends a strong message.’

PIAC acknowledges the generous support of Grata Fund and Blind Citizens Australia in the development of this case.

Media contact: PIAC Media and Communications Manager, Gemma Pearce – 0478 739 280